AnalyzingMarket com: Complete Guide to Market Analysis Platform (2025 Review)

Let’s be honest—there’s way too much information out there when you’re trying to make sense of the markets. You open one tab, then another, and suddenly you’ve got seventeen different sources telling you seventeen different things about the same stock or cryptocurrency. It’s exhausting, perhaps even a bit overwhelming if I’m being candid about it.

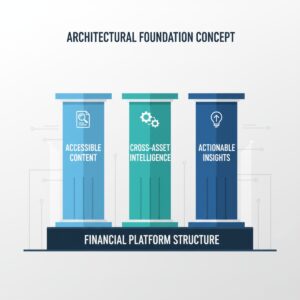

That’s where platforms like AnalyzingMarket com come into the picture. This market analysis platform aims to simplify how investors, traders, and market enthusiasts consume financial news and data. Instead of bouncing between multiple sites, AnalyzingMarket com consolidates market intelligence into one accessible hub. Or at least, that’s the promise.

In this comprehensive review, we’ll dissect what AnalyzingMarket com actually offers, who it’s designed for, and whether it lives up to the hype. We’ll look at its features, compare it with competitors, and give you the straight talk about its strengths and, yes, its limitations too. If you’re curious about how this platform stacks up against other market analysis tools, you’re in the right place.

Whether you’re a complete beginner just dipping your toes into investing, a retail trader looking for quick market summaries, or a business student who needs to stay current with economic trends, this guide will help you figure out if AnalyzingMarket com deserves a spot in your research toolkit.

What is AnalyzingMarket com?

AnalyzingMarket com is essentially a financial media platform that delivers market news, analysis, and economic updates. Think of it as a content aggregator and commentary site rolled into one. The platform covers multiple asset classes—stocks, cryptocurrencies, real estate, commodities, and broader economic trends. It’s designed, I think, for people who want market insights without getting buried in overly technical jargon or complicated charts.

The core mission seems pretty straightforward: make market research less intimidating. Rather than presenting you with raw data dumps or expecting you to understand advanced technical indicators right off the bat, AnalyzingMarket com focuses on digestible commentary and news summaries. It’s a bit like having someone translate Wall Street speak into everyday language.

Now, who exactly is this for? The platform primarily targets beginner to intermediate investors—people who are interested in the markets but maybe don’t have a finance degree or years of trading experience. Retail traders who need quick market recaps during their lunch break find value here. Business students who want to understand what’s moving markets without reading hundred-page reports appreciate the streamlined approach. Even casual market observers who just want to stay informed about economic trends can benefit.

What sets AnalyzingMarket com apart from, say, a Bloomberg terminal or even Yahoo Finance? Well, it’s the accessibility factor. While those platforms can feel overwhelming with their endless data feeds and professional-grade tools, AnalyzingMarket com strips things down to the essentials. The trade-off, of course, is that you won’t find the depth of proprietary data or advanced charting that professional traders might need. But for its target audience, that’s perhaps not really the point.

The platform publishes regular market recaps—daily summaries of what happened in major indices, standout stock performances, cryptocurrency movements, and relevant economic events. You’ll also find company-specific updates when there’s significant news, industry trend analysis, and predictions based on macroeconomic indicators. It’s not trying to be everything to everyone, which is actually kind of refreshing in a space where platforms often over-promise and under-deliver.

One thing worth noting: AnalyzingMarket com doesn’t appear to have the institutional backing or certification that some larger financial platforms boast. There’s limited information about who exactly runs the site or what their credentials are. For some users, that’s a red flag. For others, it’s less important as long as the content proves useful and accurate. We’ll dig deeper into this in the strengths and weaknesses section, but it’s something to keep in mind as you evaluate whether to trust this platform with your research needs.

The interface itself is fairly straightforward—no fancy dashboards with fifty widgets competing for your attention. You get articles, you get data summaries, and you get commentary. Simple. Perhaps too simple for advanced users, but again, that’s not who this is built for. If you want to understand the specific features in more detail, there’s plenty to explore once you get past the minimalist design.

Key Features of AnalyzingMarket com

Let’s talk about what you actually get when you use AnalyzingMarket com. The feature set isn’t as extensive as some enterprise-level platforms, but there are some genuinely useful tools and content types that make the platform worth considering.

Real-Time Data Feeds and Market Updates

The platform provides what it calls real-time data feeds, though I should clarify that these aren’t the sub-second updates you’d get from a professional trading terminal. Instead, AnalyzingMarket com offers frequently updated market data that’s current enough for most retail investors and observers. You’ll see price movements, percentage changes, and volume indicators for major stocks, indices, and cryptocurrencies.

The updates come in the form of both written summaries and data visualizations. The visualization engines are basic but functional—simple line charts, bar graphs, and comparison tables that help you spot trends quickly. Nothing groundbreaking here, but nothing overly complicated either. For someone who just wants to see if the S&P 500 is up or down today and why, it does the job.

Multi-Asset Class Coverage

One of the stronger aspects of AnalyzingMarket com is its breadth of coverage. The platform doesn’t just focus on stocks or just on crypto—it attempts to cover the full spectrum of tradable assets:

- Equities: Coverage of major U.S. and some international stock markets, including company-specific news and sector analysis

- Cryptocurrencies: Regular updates on Bitcoin, Ethereum, and other major digital assets, including regulatory news and market sentiment analysis

- Commodities: Gold, oil, agricultural products, and other commodities with price tracking and trend commentary

- Real Estate: Market trends, housing data, and commercial real estate insights—admittedly less detailed than specialized real estate platforms

- Forex: Major currency pairs and economic factors affecting exchange rates

This broad approach means you can get a holistic view of market conditions without switching between specialized platforms. When there’s a major event that affects multiple asset classes—say, a Federal Reserve interest rate decision—AnalyzingMarket com will show you how it’s rippling across stocks, bonds, commodities, and currencies. That interconnected perspective is actually pretty valuable, I think.

Market Recaps and Daily Summaries

Perhaps the most popular feature is the daily market recap. These are concise summaries published after market close (or at key intervals for 24/7 markets like crypto) that highlight the day’s most significant movements and news. The recaps typically include:

- Top gainers and losers across different asset classes

- Major economic data releases and their immediate impact

- Corporate earnings highlights or significant company announcements

- Sector performance analysis

- Notable geopolitical events affecting markets

These summaries are written in plain English—no assumption that you understand every piece of financial jargon. If there’s a technical term that needs to be used, it’s usually explained in context. For busy people who can’t watch markets all day, these recaps serve as an efficient catch-up tool.

Predictive Analysis and Market Forecasts

AnalyzingMarket com also publishes forward-looking analysis and predictions based on macroeconomic trends, technical patterns, and market sentiment. Now, here’s where I need to inject a bit of caution: no platform, no matter how sophisticated, can accurately predict markets with certainty. The predictions here should be viewed as informed opinions rather than guarantees.

That said, the forecasts are generally grounded in reasonable analysis. They’ll look at things like earnings expectations, Federal Reserve policy trajectories, seasonal patterns, and technical support/resistance levels to make educated guesses about where markets might head. Sometimes they’re right, sometimes they’re not—that’s just the nature of financial forecasting. But the reasoning behind the predictions is usually transparent, which allows you to make your own judgment calls.

Competitive Intelligence Module

This is an interesting feature that’s a bit more advanced than some of the other offerings. The competitive intelligence module tracks rival companies within the same sector, monitoring pricing moves, new product launches, marketing campaigns, and shifts in market share or customer sentiment. It’s particularly useful if you’re investing in a specific industry and want to understand the competitive dynamics.

For example, if you’re invested in electric vehicle stocks, the module might track how Tesla’s pricing strategy compares to Rivian’s, or how Ford’s EV rollout is progressing relative to GM’s. This comparative lens helps you see the bigger picture beyond just individual stock prices. Though I’ll be honest, this feature seems like it could use more depth—it’s good for high-level insights but doesn’t replace deep industry research.

Integration and Dashboard Capabilities

AnalyzingMarket com offers a unified dashboard where you can theoretically view multiple data streams at once. The idea is to consolidate consumer behaviors, competitor moves, macro trends, and economic drivers in one place. In practice, the dashboard is somewhat basic compared to platforms like TradingView or Bloomberg. You can customize what shows up to some extent, but the personalization options are limited.

The platform does allow you to set up watchlists and get alerts for specific stocks or events, which is helpful. The alert system isn’t the most sophisticated—don’t expect complex conditional alerts—but it’ll notify you when a stock hits a certain price or when major news breaks about companies you’re tracking.

If you want to really maximize what you can do with these features, there’s a comprehensive tutorial on how to use AnalyzingMarket com that walks through setup and optimization strategies.

AnalyzingMarket com Review: Strengths and Weaknesses

Alright, let’s get into the honest assessment. Every platform has its strong points and its shortcomings, and AnalyzingMarket com is no exception. I’ve spent considerable time with it, and here’s what stands out—both positively and negatively.

Strengths: What AnalyzingMarket com Does Well

Accessibility and simplicity are probably the platform’s biggest selling points. If you’re someone who gets intimidated by the sheer complexity of traditional financial platforms, AnalyzingMarket com feels welcoming. The learning curve is minimal. You can jump in and immediately start getting value without spending hours learning how to navigate menus or interpret advanced charts.

The broad asset class coverage is another major plus. Instead of needing separate accounts and subscriptions for stock research, crypto tracking, and commodity analysis, you get all of it in one place. This holistic approach helps you understand market interconnections that you might miss if you’re only looking at one asset type in isolation.

Timely market commentary is delivered consistently. The daily recaps and news updates are published promptly, which is crucial in fast-moving markets. There’s nothing more frustrating than finding a market analysis site that publishes “today’s recap” twelve hours late. AnalyzingMarket com seems to understand that timing matters, and they generally get content out when it’s still relevant.

The distraction-free design deserves mention too. There are no flashing banner ads, no pop-ups begging you to upgrade to premium every thirty seconds, no autoplay videos that start blaring when you’re trying to read. The interface is clean and focused on content. In today’s cluttered web environment, that simplicity is actually pretty refreshing.

Finally, the platform does a decent job of bridging finance and real-world impact. Instead of just telling you that oil prices went up 3%, AnalyzingMarket com will often explain what that means for gas prices, airline stocks, and inflation expectations. This contextual approach makes the information more relatable and actionable for everyday investors.

Weaknesses: Where AnalyzingMarket com Falls Short

Now for the other side. The lack of author transparency and credentials is probably the most glaring issue. When you’re reading financial analysis, it’s reasonable to want to know who’s writing it and what qualifies them to offer that analysis. AnalyzingMarket com doesn’t provide much information about its contributors, their backgrounds, or their track records. This makes it harder to assess the credibility of the analysis you’re reading.

No institutional backing or certification compounds the credibility question. Major financial platforms typically have regulatory oversight, industry certifications, or backing from established financial institutions. AnalyzingMarket com appears to operate more independently, which isn’t necessarily bad, but it does mean there’s less accountability and fewer quality assurance mechanisms.

The platform also offers no advanced data tools or interactive features. If you want to backtest a trading strategy, run custom screeners with complex filters, or dive deep into fundamental metrics with ratios and multi-year comparisons, you’re out of luck. AnalyzingMarket com is more of a content platform than a data analysis tool. For serious traders or quantitative investors, this is a significant limitation.

Limited depth on individual assets is another consideration. While the breadth of coverage is impressive, the depth sometimes suffers. You’ll get a solid overview of what’s happening, but if you want to really understand the nuances of a particular company’s financial health or a commodity’s supply-demand dynamics, you’ll need to supplement with other sources.

There’s also the issue of no community features or social elements. Platforms like StockTwits or TradingView have active communities where users can share ideas, discuss strategies, and learn from each other. AnalyzingMarket com is a one-way information flow—the platform publishes content, you consume it, end of story. There’s no commenting system, no forums, no way to engage with other users or the authors.

Lastly, the mobile experience could be better. While the site is technically mobile-responsive, the experience isn’t optimized to the degree you’d expect from a modern financial platform. There’s no dedicated mobile app, and navigating on a small screen can feel clunky at times. When you’re trying to quickly check market news on your phone between meetings, every extra tap or scroll gets annoying.

For a deeper look at whether these weaknesses are deal-breakers or just minor inconveniences for your specific needs, it’s worth exploring alternative platforms to see how they compare.

How AnalyzingMarket com Compares to Competitors

You can’t evaluate AnalyzingMarket com in a vacuum. There are dozens of market analysis platforms out there, each with their own strengths, weaknesses, and target audiences. Let’s look at how it stacks up against some of the major players.

AnalyzingMarket com vs. Yahoo Finance

Yahoo Finance is probably the most widely used free financial platform out there. It offers extensive data on stocks, mutual funds, ETFs, and more, along with news aggregation from multiple sources. The main advantage Yahoo Finance has is its comprehensive data coverage and advanced charting tools. You can drill down into historical data, compare multiple assets, and customize charts extensively.

Where AnalyzingMarket com potentially edges ahead is in editorial clarity and focus. Yahoo Finance aggregates news from everywhere, which means you’re sifting through dozens of articles, many of which might be redundant or conflicting. AnalyzingMarket com curates and synthesizes information into clearer narratives. It’s the difference between quantity and curation, I suppose.

Yahoo Finance is better for: Deep data diving, historical analysis, options trading information, extensive portfolio tracking

AnalyzingMarket com is better for: Quick daily summaries, beginner-friendly explanations, cross-asset insights without information overload

AnalyzingMarket com vs. Investing.com

Investing.com is another heavyweight in the free financial information space. It offers real-time quotes, charts, portfolios, economic calendars, and news. The platform has a global focus with coverage of markets in virtually every country. The technical analysis tools on Investing.com are significantly more robust than what you’ll find on AnalyzingMarket com.

However, Investing.com can feel overwhelming, particularly for beginners. There are so many tabs, menus, and options that it’s easy to get lost. The site also has quite a bit of advertising, which can be distracting. AnalyzingMarket com’s simpler approach is less powerful but more approachable.

Investing.com is better for: International markets, technical analysis, economic calendar tracking, multiple asset classes with deep data

AnalyzingMarket com is better for: Simplified market narratives, less cluttered interface, commentary-focused approach

AnalyzingMarket com vs. TradingView

TradingView is in a different category really—it’s primarily a charting and technical analysis platform with social networking features. The charts are industry-leading, the customization is virtually endless, and the community aspect is strong with users sharing trading ideas and strategies. For technical traders, TradingView is basically essential.

AnalyzingMarket com doesn’t even attempt to compete in the charting and technical analysis space. It’s fundamentally more about content and commentary than tools. If you’re a chart-focused trader, you’d use TradingView. If you’re a news and fundamental analysis person who wants context and explanation, AnalyzingMarket com might fit better.

TradingView is better for: Technical analysis, advanced charting, community insights, strategy backtesting

AnalyzingMarket com is better for: Quick market overviews, fundamental news, beginner-friendly content without technical complexity

AnalyzingMarket com vs. Bloomberg

Okay, this is somewhat an unfair comparison because Bloomberg Terminal costs around $20,000+ per year while AnalyzingMarket com appears to be free or low-cost. But it’s worth noting what you’re giving up by not using a professional-grade platform.

Bloomberg offers unparalleled depth of data, proprietary analysis, real-time news, messaging with other professionals, and pretty much every financial metric you could imagine. It’s the gold standard for financial professionals. But it’s also complete overkill for the average retail investor.

AnalyzingMarket com is obviously not competing with Bloomberg. Different leagues entirely. But for someone who just wants to stay informed about markets without the professional-grade complexity and cost, AnalyzingMarket com serves a legitimate purpose.

Quick Comparison Table

| Platform | Best For | Key Strength | Key Weakness | Cost |

|---|---|---|---|---|

| AnalyzingMarket com | Beginner investors, quick summaries | Simplified, curated content | Limited data tools, credibility questions | Free/Low-cost |

| Yahoo Finance | General retail investors | Comprehensive free data | Information overload | Free |

| Investing.com | International market tracking | Global coverage, economic calendar | Cluttered interface, ads | Free with premium option |

| TradingView | Technical traders | Best-in-class charting | Less focus on fundamental news | Free with premium tiers |

| Bloomberg Terminal | Finance professionals | Unmatched data depth | Extremely expensive, complex | $20,000+/year |

The reality is that most savvy investors use multiple platforms, each serving different purposes. Perhaps you use TradingView for charting, Yahoo Finance for quick data checks, and AnalyzingMarket com for digestible market narratives. There’s no rule saying you have to pick just one.

Getting Started with AnalyzingMarket com

So you’ve decided to give AnalyzingMarket com a try. Good. Let’s walk through how to actually get started and make the most of what the platform offers, even if it’s just as a supplementary resource in your research toolkit.

Initial Setup and Navigation

The good news is that getting started is about as straightforward as it gets. Unlike some platforms that require extensive profile setup and verification processes, AnalyzingMarket com is pretty low-friction. You can typically access most content without even creating an account, though registration might unlock some additional features or personalization options.

If registration is required or beneficial, the process is standard: email address, password, maybe some basic preferences about which asset classes you’re most interested in. No complex identity verification or financial background questionnaires needed.

Once you’re in, the main navigation is usually organized by asset class or content type. You’ll see sections for stocks, crypto, commodities, real estate, and perhaps a general news or market overview section. Some platforms also categorize by timeframe—daily updates, weekly analysis, long-term forecasts, etc.

Setting Up Your Watchlist

One of the first things you should do is set up a watchlist or favorites list for the assets you care most about. If you’re primarily interested in tech stocks, add Apple, Microsoft, Google, Nvidia, and whatever else you follow to your watchlist. For crypto enthusiasts, add Bitcoin, Ethereum, and your favorite altcoins.

The watchlist feature, assuming AnalyzingMarket com has one that’s functional, should let you quickly see price movements and access relevant news for your selected assets. This saves you from wading through information about hundreds of stocks you don’t care about.

Understanding the Content Cadence

Pay attention to when content is published. Most market analysis platforms have a rhythm to their publishing schedule. Daily recaps might come out right after market close. Pre-market analysis might publish early morning. Crypto updates, since that market never sleeps, might be published multiple times per day or at specific intervals.

Understanding this cadence helps you know when to check back for fresh information. If you know the daily market recap always drops at 4:30 PM EST, you can make that part of your routine—quick check during your commute home or right before dinner to see what happened in markets that day.

Best Practices for Beginners

If you’re new to market analysis in general, not just to AnalyzingMarket com, here are some tips that’ll serve you well:

- Don’t make investment decisions based on a single source. Ever. Always cross-reference information, especially if it’s going to inform a buy or sell decision. Use AnalyzingMarket com as one input among several.

- Start with the summaries and recaps rather than diving into complex analysis. Build your understanding gradually. Once the basics make sense, you can move into more detailed content.

- Pay attention to the context and reasoning behind any predictions or analysis. Don’t just look at “Stock X is expected to rise”—understand why the platform thinks that and evaluate whether the reasoning makes sense to you.

- Use the platform consistently for a few weeks before deciding if it’s valuable for you. One or two visits won’t give you a real sense of whether the content quality is reliable and whether the platform fits your needs.

- Note any biases or patterns in the coverage. Does the platform seem overly bullish all the time? Is it always predicting doom and gloom? Quality analysis should be balanced and evidence-based, not always pushing one narrative.

For a more thorough walkthrough of the platform’s interface and features, check out this step-by-step tutorial that covers everything from basic navigation to advanced usage strategies.

Advanced Tips for Using AnalyzingMarket com

Once you’ve got the basics down and you’ve been using AnalyzingMarket com for a while, there are some strategies that can help you extract even more value from the platform. These are particularly useful if you’re using it as part of a broader research workflow.

Cross-Referencing Strategy

This is perhaps the most important advanced technique: systematic cross-referencing. When you read a piece of analysis or market prediction on AnalyzingMarket com, don’t just accept it at face value. Pull up Yahoo Finance or Investing.com and verify the data points mentioned. Check if other reputable sources are reporting the same trends or reaching similar conclusions.

This isn’t about distrusting AnalyzingMarket com specifically—it’s about good research hygiene in general. Any single platform, no matter how reputable, can have errors, biases, or blind spots. By cross-referencing, you’re building a more complete and accurate picture of what’s actually happening in markets.

Create a simple routine: read the AnalyzingMarket com daily recap, note any particularly interesting or surprising claims, then spend 5-10 minutes verifying those points with other sources. If multiple sources agree, you can be more confident. If you’re seeing conflicting information, dig deeper to understand where the discrepancy comes from.

Integration with Technical Analysis Tools

Since AnalyzingMarket com is more focused on fundamental news and commentary, consider pairing it with a technical analysis platform like TradingView. Use AnalyzingMarket com to understand the “why” behind market movements—the news, earnings, economic data, sentiment shifts. Then use TradingView to understand the “what”—the actual price action, support and resistance levels, momentum indicators.

This combination gives you both fundamental and technical perspectives, which is what professional traders typically use. The fundamental side helps you understand the bigger picture and longer-term drivers. The technical side helps you understand entry and exit points and short-term momentum.

Creating Your Personalized Research Workflow

Don’t just use AnalyzingMarket com randomly whenever you remember to check it. Instead, build it into a structured research routine. Here’s an example workflow that incorporates AnalyzingMarket com effectively:

Morning Routine (15 minutes):

- Check AnalyzingMarket com pre-market summary to understand overnight developments

- Review your watchlist to see if any of your holdings have specific news

- Note any major economic data releases scheduled for the day

Midday Check (5 minutes):

- Quick scan for any breaking news or major intraday moves

- Review any alerts from your watchlist

Evening Review (20 minutes):

- Read the full daily market recap on AnalyzingMarket com

- Cross-reference any surprising information with Yahoo Finance or other sources

- Look at the charts on TradingView for any stocks mentioned in the recap

- Update your personal notes or trading journal with key insights

Weekly Deep Dive (30-60 minutes):

- Read the weekly analysis or longer-form content on AnalyzingMarket com

- Look at sector performance and rotation trends

- Review your portfolio in light of the week’s news and analysis

- Research any new investment ideas that came up during the week

This kind of structured approach ensures you’re consistently informed without letting market research take over your entire life. Adjust the timing and depth based on your personal schedule and investment style.

Leveraging the Competitive Intelligence Features

If you’re investing in specific sectors, really dig into the competitive intelligence module. Let’s say you’re interested in the streaming wars—Netflix, Disney+, HBO Max, etc. Use AnalyzingMarket com to track how these companies are positioning against each other: subscriber growth rates, pricing changes, content spending, international expansion.

The key is to look for relative performance, not just absolute numbers. It doesn’t matter that Netflix added a million subscribers if Disney+ added five million in the same period. The competitive intelligence angle helps you understand these dynamics, which can inform which company in a sector might be the better investment.

Using Predictions as Discussion Starters, Not Gospel

When AnalyzingMarket com publishes predictions or forecasts, treat them as hypotheses to evaluate rather than prophecies to follow. Ask yourself: What assumptions is this prediction based on? What would have to happen for this prediction to be right? What could go wrong that would invalidate it?

This critical thinking approach makes you a better investor overall. You’re not just consuming information passively—you’re actively engaging with it, questioning it, testing it against your own understanding and other sources.

If you really want to maximize the value you get from the platform, there’s a dedicated guide on getting the most out of AnalyzingMarket com that goes even deeper into optimization strategies and advanced techniques.

Use Cases: Real-World Applications of AnalyzingMarket com

Theory is one thing, but how do people actually use AnalyzingMarket com in practice? Let’s look at some real-world scenarios where the platform provides genuine value.

For the Beginner Investor

Meet Sarah—she’s 28, works in marketing, and has been contributing to her 401(k) but wants to start investing in individual stocks. The problem? Financial news reads like a foreign language to her. When she tried Yahoo Finance, she was overwhelmed by all the data and jargon.

AnalyzingMarket com works for Sarah because it translates market events into understandable narratives. When the Federal Reserve raises interest rates, the platform doesn’t just report the number—it explains what that means for different sectors, why growth stocks tend to suffer in rising rate environments, and what it might mean for her portfolio. This educational approach helps Sarah gradually build her financial literacy while staying informed.

She uses the daily recaps as a learning tool, looking up concepts she doesn’t understand, and over time, she’s becoming more confident in her investing decisions. The platform serves as a bridge between complete beginner and informed investor.

For the Retail Trader

Mike is a retail trader who swing trades stocks and options. He has a full-time job, so he can’t watch markets all day. He needs efficient ways to stay informed without spending hours on research.

Mike checks AnalyzingMarket com during his lunch break and right after market close. The summaries tell him quickly if there were any significant moves or news that might affect his positions. If the platform mentions that a stock in his watchlist had unusual volume or a big price swing, he’ll dig deeper using his TradingView charts and other resources.

For Mike, AnalyzingMarket com is a triage tool—it helps him quickly identify what requires his attention so he can focus his limited research time on what matters most. He doesn’t rely on it for trade signals, but he uses it as an efficient news filter.

For Business Students

James is an MBA student who needs to stay current with business and economic news for class discussions and case studies. His professors expect students to be aware of major market events and trends. But between classes, group projects, and part-time work, he doesn’t have time to read the Wall Street Journal cover to cover every day.

AnalyzingMarket com gives James a quick daily dose of what’s happening in markets and the economy. When his finance professor asks the class to discuss how recent inflation data might affect monetary policy, James has already read about it in yesterday’s recap. When there’s a case study about a company, he can quickly check if there’s recent news or analysis about that firm on the platform.

The platform helps him stay engaged in class discussions without requiring hours of daily reading. It’s efficient enough to fit into a student’s busy schedule while providing enough depth to sound informed.

For the Cryptocurrency Enthusiast

Lisa has been involved in cryptocurrency since 2020. She holds Bitcoin, Ethereum, and a few altcoins, and she wants to stay informed about regulatory developments, major price movements, and emerging trends in the crypto space.

She uses the cryptocurrency section of AnalyzingMarket com to get a quick overview of what’s happening in the crypto markets. Since crypto trades 24/7, there’s always something happening, and the platform’s regular updates help her catch important developments she might have otherwise missed while she was sleeping or working.

When the platform reports on something significant—maybe a new regulatory proposal or a major hack—Lisa can then dive deeper using crypto-specific sources like CoinDesk or CryptoSlate. But AnalyzingMarket com serves as her initial alert system and provides helpful context that connects crypto developments to broader financial markets. For more specific guidance on using the platform for crypto, there’s a detailed cryptocurrency analysis guide available.

For the Market Enthusiast

Then there’s Tom—he’s retired, financially comfortable, and just genuinely interested in how markets work. He’s not day trading or making frequent changes to his portfolio, but he enjoys understanding economic trends and market dynamics. It’s like a hobby for him, maybe a bit of an intellectual curiosity.

Tom reads AnalyzingMarket com most mornings with his coffee, much like previous generations read the business section of the newspaper. He finds the cross-asset perspective interesting—understanding how geopolitical events affect oil prices, which affects airline stocks, which affects travel-related real estate, and so on. These interconnections are fascinating to him.

He doesn’t need the information for any specific decision-making purpose. He’s already well-diversified in low-cost index funds. But staying informed keeps his mind sharp, gives him interesting topics to discuss with friends, and helps him understand the economic environment his children and grandchildren are navigating.

Pricing and Accessibility

One area that’s a bit unclear with AnalyzingMarket com is the exact pricing structure. From what I can gather, much of the content appears to be free or low-cost, which is a significant advantage over premium financial data services that can cost hundreds or thousands per year.

If there is a premium tier, it likely offers additional features like more detailed analysis, earlier access to research, enhanced data tools, or an ad-free experience. But honestly, the information available publicly about pricing tiers is limited, which is somewhat frustrating. You may need to visit the site directly or contact them to understand exactly what’s free versus what requires payment.

In terms of accessibility across devices, the platform is web-based and should work on desktops, laptops, tablets, and smartphones. However, as mentioned earlier, there doesn’t appear to be a dedicated mobile app, which would provide a better user experience on phones. The mobile web experience is functional but not optimized to the degree you’d hope for.

The platform should be accessible from any modern web browser—Chrome, Firefox, Safari, Edge—without requiring any special software or plugins. This is standard for web-based platforms and makes it easy to access from work computers, personal devices, or even a friend’s laptop if needed.

Expert Opinion and Final Verdict on AnalyzingMarket com

After looking at all aspects of the platform, here’s my honest assessment: AnalyzingMarket com fills a specific niche in the market analysis ecosystem. It’s not trying to be a professional-grade terminal or an advanced charting platform. Instead, it’s positioning itself as an accessible, digestible market intelligence source for retail investors and market observers.

For its target audience—beginners to intermediate investors who want understandable market commentary without overwhelming complexity—it largely succeeds. The content is generally clear, the breadth of asset class coverage is impressive for a platform at this level, and the simplicity of the interface is actually a strength rather than a weakness for people who get intimidated by more complex platforms.

However, the credibility issues are real and shouldn’t be dismissed. The lack of transparency about who’s producing the content, what their qualifications are, and what editorial standards are in place makes it harder to fully trust the analysis. This doesn’t necessarily mean the content is bad or inaccurate—it just means you need to be more cautious and do more verification compared to platforms with established reputations and transparent editorial processes.

The absence of advanced data tools and interactive features means AnalyzingMarket com works best as a supplementary resource rather than your primary research platform. Use it for the narrative and context, but verify data points and supplement with more robust platforms when you need to dig deeper.

Who Should Use AnalyzingMarket com?

Ideal users:

- Beginner investors who are intimidated by more complex financial platforms

- Retail traders who need quick, digestible market summaries

- Business students wanting to stay informed without massive time investment

- Market enthusiasts interested in a broad perspective across multiple asset classes

- People looking for a starting point before diving into deeper research

Not ideal for:

- Professional traders who need real-time data and advanced analytical tools

- Quantitative investors who require extensive historical data and backtesting capabilities

- People who only trust established, institutionally-backed financial platforms

- Investors who need deep, exhaustive analysis of individual securities

- Anyone looking for a single comprehensive platform that does everything

My Recommendation

If you’re new to market analysis or you find other platforms too overwhelming, give AnalyzingMarket com a try. It’s low-risk since it appears to be mostly free, and you might find the simplified approach refreshing. Use it as one source among several—pair it with Yahoo Finance for data verification, TradingView for technical analysis, and perhaps some industry-specific sources for deeper dives.

As you become more sophisticated in your investing approach, you’ll likely need to graduate to more comprehensive platforms or at least supplement heavily with other tools. Think of AnalyzingMarket com as training wheels—helpful when you’re learning, but eventually you’ll want to move beyond them.

For experienced investors, the platform still has value as a quick catch-up tool. If you just want to spend five minutes getting the market’s headlines before diving into your own analysis, it can serve that purpose efficiently. Just don’t rely on it as your sole source for investment decisions.

If you’re still undecided about whether this is the right platform for you, comparing it side-by-side with other market analysis tools might help clarify which option best fits your specific needs and skill level.

Frequently Asked Questions About AnalyzingMarket com

Is AnalyzingMarket com free to use?

Most content on AnalyzingMarket com appears to be accessible for free or at low cost, though there may be premium features or tiers that require payment. The exact pricing structure isn’t completely transparent, so you may need to explore the platform directly to understand what’s included in free access versus paid subscriptions. Generally, basic market summaries and news commentary seem to be available without payment.

Can I trust the analysis on AnalyzingMarket com?

This is a legitimate concern. The platform lacks transparency about its authors’ credentials and doesn’t have the institutional backing of larger financial services. This doesn’t automatically mean the content is unreliable, but it does mean you should exercise caution. Always cross-reference significant claims with established sources like Yahoo Finance, Bloomberg, or Reuters. Use AnalyzingMarket com as one input in your research, not your sole source of information.

Does AnalyzingMarket com offer real-time data?

The platform provides frequently updated market data, but it’s not the sub-second real-time feeds you’d get from a professional trading terminal. For most retail investors and market observers, the update frequency is sufficient to stay informed about major market movements. If you’re day trading and need instant, second-by-second data, you’ll need a more specialized platform.

Is there a mobile app for AnalyzingMarket com?

From available information, there doesn’t appear to be a dedicated mobile app. The platform is accessible through mobile web browsers, but the experience isn’t optimized to the same degree as a native app would be. This is one area where the platform lags behind competitors like Investing.com or Yahoo Finance, which offer robust mobile applications.

What asset classes does AnalyzingMarket com cover?

The platform covers a broad range of asset classes including stocks, cryptocurrencies, commodities, real estate, and forex markets. This multi-asset approach is actually one of its strengths, allowing you to understand how different markets interconnect and influence each other. However, the depth of coverage for each asset class varies, with some areas more thoroughly analyzed than others.

How does AnalyzingMarket com make money?

The revenue model isn’t entirely clear from publicly available information. Possibilities include premium subscriptions, advertising, affiliate relationships with brokers or financial services, or some combination. The lack of transparency here is notable and something users should be aware of, as revenue models can sometimes create incentives that affect content.

Can I use AnalyzingMarket com for day trading?

It’s not really designed for day trading. The platform is more focused on news, commentary, and daily summaries rather than the real-time data, advanced charting, and quick execution tools day traders require. You could use it as a supplementary source to understand broader market context, but you’d need other platforms for actual day trading activities.

Does AnalyzingMarket com provide investment recommendations?

The platform provides analysis and sometimes predictions or forecasts, but these should be understood as opinions and perspectives rather than formal investment recommendations. Always do your own due diligence before making any investment decisions. No platform, regardless of reputation, should be the sole basis for buying or selling securities.

How often is content updated on AnalyzingMarket com?

Content appears to be updated daily at minimum, with market recaps published after major market closes. For 24/7 markets like cryptocurrency, updates may be more frequent. The platform seems to understand that timing matters in financial markets, and content is generally published while it’s still relevant rather than hours or days after events occur.

Can I customize what I see on AnalyzingMarket com?

There appear to be some customization options, such as creating watchlists for specific stocks or assets you want to follow. However, the personalization capabilities seem limited compared to more advanced platforms. You likely won’t be able to create highly customized dashboards with complex layouts and multiple data feeds. The platform prioritizes simplicity over deep customization.

Conclusion: Is AnalyzingMarket com Worth Your Time?

Look, I think AnalyzingMarket com has a place in the market research ecosystem, even if it’s not perfect. It’s trying to solve a real problem—financial information is often overwhelming, jargon-filled, and scattered across dozens of sources. By consolidating and simplifying, the platform makes market intelligence more accessible to regular people who don’t have finance degrees or hours each day to devote to research.

The strengths are clear: broad asset class coverage, simplified explanations, timely content, and a distraction-free interface. For beginners especially, these qualities make the platform a legitimate starting point for understanding how markets work and what’s driving daily movements.

But the weaknesses can’t be ignored either. The lack of author credentials and transparency, the absence of advanced analytical tools, and the limited depth on individual assets means you’ll outgrow this platform or need to supplement it heavily as you become more sophisticated. The credibility questions, while not disqualifying, do require that you approach the content with appropriate skepticism and verification.

My advice? Use AnalyzingMarket com as part of a diversified information diet. Read the daily recap to get oriented. Cross-reference important claims with established sources. Supplement with technical analysis from TradingView and data from Yahoo Finance or Investing.com. Build a routine that incorporates multiple perspectives and sources.

Don’t expect AnalyzingMarket com to be your one-stop shop for everything market-related—it’s not designed to be that. But as a digestible, accessible entry point into market analysis, particularly for people who find traditional financial platforms intimidating, it serves a useful purpose.

The platform is probably most valuable in its first few months of use, when you’re learning the basics and building your financial literacy. As you progress, you’ll naturally want more depth, more data, and more sophisticated tools. And that’s fine—use the platform for what it’s good at during the phase when you need it most.

For anyone still figuring out their ideal market research workflow, exploring differentstrategies to maximize platform value can help you extract the most benefit while you’re using it and know when it’s time to expand your toolkit with additional resources.

In the end, the best market analysis approach is the one you’ll actually use consistently. If AnalyzingMarket com’s simplicity means you’ll engage with market news regularly instead of avoiding it because other platforms feel too complex, then it’s doing its job. Start here, learn the basics, build confidence, and gradually expand to more comprehensive tools as your needs evolve. That’s probably the most sensible path forward for most people.