Best Market Analysis Tools in 2025: Complete Comparison Guide

Choosing the right market analysis tool can feel a bit like standing in front of a massive buffet—there’s so much to pick from that you’re not sure where to even start. Should you go with the familiar names everyone uses? Try something new? Splurge on premium features or stick with free options? Honestly, it’s overwhelming, and I get it.

The truth is, there’s no single “best” tool that works for everyone. Your ideal platform depends on your experience level, budget, trading style, and what exactly you’re trying to accomplish. A day trader needs something completely different from a long-term investor or a business student just trying to stay informed about market trends.

In this comprehensive comparison guide, we’re breaking down the top market analysis tools available in 2025. We’ll look at what each platform does well, where it falls short, and most importantly, who it’s actually designed for. Whether you’re exploring options like AnalyzingMarket com or wondering how it stacks up against the big names, you’ll find the answers here.

By the end of this guide, you’ll have a clear understanding of which tools deserve a spot in your research arsenal and which ones you can safely skip. Let’s dive in.

What Makes a Good Market Analysis Tool?

Before we get into specific platforms, it’s worth establishing what actually matters in a market analysis tool. Not all features are created equal, and what’s critical for one person might be completely useless for another.

The most important factors, I think, come down to a handful of key areas:

Data quality and accuracy should be at the top of your list. If the numbers are wrong or outdated, nothing else matters. You need reliable, timely data that you can actually trust when making decisions. Some platforms have better data sourcing than others, and this often correlates with price—though not always.

Then there’s ease of use and interface design. A tool can have every feature in the world, but if it takes you twenty minutes to figure out how to find a simple stock quote, it’s not helping anyone. The best platforms balance power with accessibility. They don’t dumb things down, but they also don’t make you feel like you need a PhD just to navigate the main dashboard.

Coverage and breadth matter too. Do you need international markets or just U.S. stocks? Are you interested in cryptocurrencies? Commodities? Options? Forex? Make sure the platform actually covers what you’re trying to trade or research. It sounds obvious, but you’d be surprised how often people sign up for a service only to discover it doesn’t track the specific assets they care about.

The quality of analysis and insights varies dramatically between platforms. Some just give you raw data and let you figure out what it means. Others provide commentary, predictions, and contextual analysis. Neither approach is inherently better—it depends on your skill level and what you’re looking for. Beginners often need more hand-holding, while experienced traders might prefer to form their own opinions without someone else’s interpretation clouding the picture.

Cost and value is obviously a consideration for most of us. Free tools can be surprisingly capable, but they usually have limitations—whether it’s fewer features, delayed data, advertisements, or restricted access. Premium tools offer more, but only if you actually use those extra features. Paying $500/month for advanced analytics you never touch is just wasting money.

Finally, reliability and reputation can’t be ignored. Has the platform been around for a while? Do they have institutional backing? What do other users say about their experience? A flashy new tool might look great on paper, but if it’s constantly crashing or the company has questionable credibility, that’s a problem.

The Best Market Analysis Tools: Detailed Comparison

Alright, let’s get into the actual platforms. We’ve organized these roughly from most accessible to most advanced, though there’s obviously some overlap.

1. Yahoo Finance

Let’s start with probably the most widely used free platform out there. Yahoo Finance has been the go-to source for retail investors for decades now, and there’s a reason it’s still standing.

The platform offers extensive coverage of stocks, ETFs, mutual funds, indices, currencies, and commodities. You get real-time quotes (with a slight delay for free users), interactive charts, company financials, analyst ratings, and a ton of news aggregated from multiple sources. The portfolio tracking features are solid, and you can set up watchlists and price alerts without much hassle.

What Yahoo Finance does particularly well is providing depth without overwhelming complexity. The interface has been refined over many years of user feedback. You can drill down into earnings reports, compare stocks side-by-side, look at historical data going back decades, and customize charts with various technical indicators. For a free platform, it’s honestly impressive what you get.

The downsides? The sheer amount of information can be overwhelming if you’re a complete beginner. There’s also a lot of advertising on the free version, which some people find distracting. The mobile app is decent but not as polished as some competitors. And while the news aggregation is comprehensive, you’re often sifting through dozens of articles that basically say the same thing in slightly different ways.

Best for: General retail investors who want comprehensive free data, portfolio tracking, and don’t mind a slightly cluttered interface

Pricing: Free with ads; Premium available at $34.99/month for ad-free experience and additional features

2. Investing.com

If Yahoo Finance is the American standard, Investing.com is its more internationally-focused cousin. This platform offers truly global coverage—pretty much every stock market in the world, plus forex, crypto, commodities, bonds, and more.

One of Investing.com’s strongest features is its economic calendar, which tracks upcoming earnings releases, economic data announcements, central bank meetings, and other market-moving events. If you’re the type who trades around news and data releases, this is invaluable. The technical analysis tools are also more robust than Yahoo Finance, with better charting capabilities and more indicators.

The platform also has an active community aspect where users can share ideas, comment on assets, and follow other traders. This social element isn’t for everyone, but some people find value in seeing what the broader retail trading community is thinking.

However, Investing.com can feel cluttered and busy. There are ads everywhere on the free version, pop-ups, notifications—it’s a lot. The mobile app, while functional, tries to do too much and ends up feeling cramped. And honestly, the quality of user-generated content in the community section is… mixed, to put it charitably.

Best for: Traders focused on international markets, economic calendar tracking, technical analysis, and those who don’t mind a busy interface

Pricing: Free with ads; Investing Pro starts at $14.99/month with varying tiers

3. TradingView

Now we’re getting into more specialized territory. TradingView is the gold standard for charting and technical analysis. If you’re serious about reading charts, this is probably where you’ll end up eventually.

The charting capabilities are simply unmatched among retail-accessible platforms. You can customize literally every aspect of your charts, overlay dozens of indicators, draw trendlines and patterns, and save your layouts for quick access later. The platform supports backtesting, allows you to create custom indicators using Pine Script (their proprietary coding language), and integrates with various brokers for direct trading.

The social features are actually useful here, unlike some other platforms. You can follow experienced traders, see what charts they’re looking at, read their analysis, and learn from their approaches. The “Ideas” section features user-submitted technical analysis that ranges from thoughtful and educational to completely speculative—you learn to filter pretty quickly.

Where TradingView is less strong is in fundamental analysis and news. You can see company financials and there’s a news feed, but that’s not really what the platform is built for. It’s chart-first, everything else second. Also, while the free version is usable, you’ll quickly hit limitations that push you toward paid tiers if you want to do serious analysis.

Best for: Technical traders, chart enthusiasts, anyone who needs advanced charting capabilities and community-driven analysis

Pricing: Free with limitations; Pro starts at $14.95/month, Pro+ at $29.95/month, Premium at $59.95/month

4. AnalyzingMarket com

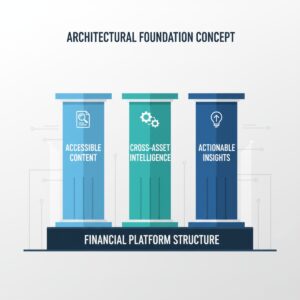

Speaking of platforms with different approaches, AnalyzingMarket com takes a more content-focused angle rather than being a pure data platform. It’s designed for people who want market intelligence presented in an understandable, digestible format.

The platform provides daily market recaps, news summaries, and analysis across multiple asset classes—stocks, crypto, commodities, real estate, and forex. Instead of throwing raw data at you and expecting you to figure it out, AnalyzingMarket com curates and synthesizes information into coherent narratives. When something significant happens in markets, they explain not just what happened, but why it matters and what the potential implications are.

This approach is particularly valuable for beginners or busy people who don’t have hours to spend researching. You can catch up on what happened in markets in just a few minutes of reading. The interface is clean and distraction-free—no overwhelming dashboards with fifty widgets competing for attention.

The trade-offs are pretty clear though. You don’t get the deep data tools that platforms like Yahoo Finance or TradingView offer. There’s no advanced charting, no screeners with complex filters, no portfolio tracking. It’s more of an information source than an analysis toolkit. There are also some credibility questions due to limited transparency about who produces the content, which is something to be aware of. For a more detailed look at this platform specifically, check out our comprehensive review of AnalyzingMarket com.

Best for: Beginner investors, people wanting quick market summaries, those who prefer narrative-driven content over raw data

Pricing: Appears to be free or low-cost for most content

5. Bloomberg Terminal

Okay, this one is in a completely different league financially, but it’s worth mentioning because it’s the benchmark for professional-grade market data. The Bloomberg Terminal is what you’ll find on the desks of Wall Street traders, hedge fund managers, and professional analysts.

What do you get for that $20,000+ annual price tag? Essentially everything. Real-time data on virtually every tradable asset in the world, proprietary news and analysis from Bloomberg’s own reporters, direct messaging with other Bloomberg users, company financials going back decades, economic data, analytics tools that would take pages to describe, and perhaps most valuably, the Bloomberg Terminal’s unique culture and network effects.

For retail investors, this is complete overkill. You’re paying for speed, depth, and tools that are designed for people managing millions or billions of dollars. Unless you’re a professional or extremely serious trader with significant capital, you simply don’t need this level of service. It’s like buying a Formula 1 race car when you just need to drive to the grocery store.

We’re including it here mostly for perspective—to show what the absolute top end looks like and to illustrate that you definitely don’t need to spend this kind of money to be a successful investor.

Best for: Financial professionals, institutional investors, those with serious capital and need for professional-grade tools

Pricing: Approximately $20,000-24,000 per year per terminal

6. Seeking Alpha

Seeking Alpha occupies an interesting middle ground between data platforms and content sites. It offers stock quotes, charts, and company data, but the real value is in its vast library of user-contributed analysis articles and its earnings call transcripts.

The platform has thousands of contributors who write detailed analyses of companies, sectors, and markets. The quality varies—some contributors are genuinely knowledgeable professionals providing valuable insights, while others are… less rigorous. You learn to identify which authors provide consistently good analysis and follow them.

The earnings call transcripts are particularly valuable. Rather than trying to listen to hour-long calls yourself, you can quickly read through the transcript and search for specific topics or questions. The platform also provides historical data on dividend payments, which is useful for income-focused investors.

The comment sections can be entertaining or infuriating depending on your perspective. They’re often filled with passionate bulls and bears arguing about whether a stock is going to the moon or crashing to zero. Sometimes useful perspectives emerge from these discussions, but there’s also a lot of noise to filter through.

Best for: Fundamental investors who value detailed written analysis, dividend investors, those who want to see diverse perspectives on individual stocks

Pricing: Free with limitations; Premium starts at $239/year, Pro at $599/year

7. Finviz

If you need to quickly scan the market and find interesting opportunities, Finviz (Financial Visualizations) is hard to beat. This platform is all about efficiency—presenting huge amounts of information in visual formats that you can process quickly.

The stock screener is the main attraction. You can filter stocks by dozens of fundamental and technical criteria, then view the results in a heat map that shows you at a glance which sectors and stocks are moving. The free version is surprisingly capable, though the paid version adds real-time data and more advanced features.

Finviz also offers portfolio tracking, forex charts, crypto quotes, and a futures section. The interface is no-nonsense and a bit dated-looking, but it’s fast and information-dense. This isn’t a platform for beginners who need hand-holding—it assumes you know what you’re looking at.

The main limitation is that it’s U.S.-focused. If you need international market coverage, you’ll have to look elsewhere. The mobile experience is also lacking compared to competitors—the site works on mobile browsers but isn’t really optimized for small screens.

Best for: Active traders who need to screen for opportunities quickly, visual learners who process heat maps well, U.S. market-focused investors

Pricing: Free version available; Elite at $39.50/month or $299.50/year

8. Morningstar

Morningstar is the go-to platform for fundamental analysis, particularly for long-term investors focused on mutual funds and ETFs. Their star rating system for funds is widely recognized, and their equity research reports are thorough and well-regarded.

The platform excels at helping you evaluate whether an investment is fairly valued. Their analysts produce estimates of fair value for stocks and compare current prices to those estimates. The methodology is transparent and based on discounted cash flow analysis. Whether you agree with their specific valuations or not, it’s useful to see a well-reasoned perspective.

Morningstar is particularly strong for retirement-focused investors trying to build diversified portfolios of funds. The screening tools help you find funds that match your criteria for expense ratios, management quality, risk levels, and asset allocation. The educational content is also top-notch—they genuinely try to help people become better investors, not just sell them stuff.

The platform feels a bit old-school compared to flashier competitors. It’s not designed for active traders or people who need real-time data and charts. This is more of a weekend research platform—you’re not going to be checking Morningstar on your phone between meetings to see how your day trades are going.

Best for: Long-term investors, retirement planning, fund research, fundamental analysis enthusiasts, value investors

Pricing: Free version with limitations; Premium at $34.95/month or $249/year

9. Stock Rover

For investors who love diving deep into financial metrics and creating custom screening strategies, Stock Rover is a hidden gem that doesn’t get as much attention as it deserves.

The platform allows you to screen stocks using over 600 different metrics—basically every financial ratio, valuation measure, growth rate, and technical indicator you can think of. You can create custom layouts to display exactly the data you care about, compare stocks side-by-side with incredible granularity, and backtest screening strategies to see how they would have performed historically.

The research reports are solid, pulling together key metrics and visualizations in an easy-to-digest format. The portfolio analysis tools help you understand your overall exposure to different sectors, countries, and risk factors. For people who manage their own portfolios actively, this kind of analysis is invaluable.

The learning curve is steeper than beginner-friendly platforms. Stock Rover assumes you understand financial statements and what various metrics mean. If terms like “price-to-free-cash-flow” or “return on invested capital” are foreign to you, you’ll need to do some learning before getting the most out of this platform.

Best for: Serious retail investors who want institutional-quality screening and analysis tools, data-driven investors, portfolio managers

Pricing: Free version available; Essentials at $7.99/month, Premium at $17.99/month, Premium Plus at $27.99/month

10. Koyfin

Wrapping up our list is Koyfin, a relative newcomer that’s gaining traction among retail investors who want something more powerful than Yahoo Finance but less expensive than Bloomberg.

Koyfin brings together market data, financials, estimates, and news in a clean, modern interface. You can build custom dashboards with the exact information you want to see, compare multiple stocks or indices simultaneously, and access detailed financial data going back years. The charting is solid, the screener is capable, and the overall user experience feels polished.

What sets Koyfin apart is its balance of power and usability. It’s more sophisticated than the basic free platforms but doesn’t require professional-level knowledge to navigate. The free tier is genuinely useful, not just a teaser designed to frustrate you into upgrading, though the paid versions do unlock significantly more capabilities.

The platform is still evolving and adding features, which is both good and bad. Good because it’s actively improving, bad because sometimes you’ll find limitations or missing features that you’d expect from a mature platform. The community and educational resources are also less developed compared to established players.

Best for: Retail investors who’ve outgrown Yahoo Finance but don’t need full professional-grade tools, those who value clean interface design

Pricing: Free version available; paid tiers start around $29/month with higher tiers for professional use

Comparison Table: Key Features at a Glance

| Platform | Best Feature | Weakest Point | Mobile App | Starting Price | Ideal User |

|---|---|---|---|---|---|

| Yahoo Finance | Comprehensive free data | Information overload, ads | Good | Free | General retail investors |

| Investing.com | Global coverage, economic calendar | Cluttered interface | Good | Free | International traders |

| TradingView | Best-in-class charting | Limited fundamental analysis | Excellent | Free (limited) | Technical traders |

| AnalyzingMarket com | Digestible market summaries | No advanced tools, credibility questions | Browser only | Free/Low-cost | Beginners |

| Bloomberg Terminal | Everything imaginable | Extremely expensive, overkill for retail | Yes (mobile version) | $20,000+/year | Professionals |

| Seeking Alpha | User-contributed analysis | Variable content quality | Good | Free (limited) | Fundamental investors |

| Finviz | Visual screener, heat maps | U.S. only, outdated interface | Poor | Free | Active screeners |

| Morningstar | Fund research, fair value estimates | Not for active traders | Decent | Free (limited) | Long-term investors |

| Stock Rover | Deep screening capabilities | Steep learning curve | Browser only | Free (limited) | Data-driven investors |

| Koyfin | Balance of power and usability | Still maturing | Good | Free (limited) | Advancing retail investors |

Choosing the Right Tool for Your Needs

With so many options, how do you actually decide? Here’s my suggestion: think about your specific situation rather than trying to find some universal “best” platform.

If You’re Just Starting Out

Begin with free platforms that have gentle learning curves. Yahoo Finance or AnalyzingMarket com are good starting points. Don’t overwhelm yourself with advanced features you’re not ready to use yet. Focus on understanding the basics—how to look up a stock, read basic financial metrics, and interpret market news.

As you get more comfortable, you might add Seeking Alpha to read different perspectives on investments you’re considering. The goal in this phase is building literacy and confidence, not sophisticated analysis.

If You’re Focused on Technical Trading

There’s really no getting around it—you need TradingView. Start with the free version to learn the basics of technical analysis, then upgrade to a paid tier when you hit the limitations. Supplement with Finviz for quick market scanning and opportunity identification.

You might also use Yahoo Finance or Investing.com for checking company news and earnings, since TradingView is lighter on that side of things. But your primary workspace will be those charts.

If You’re a Long-Term, Fundamental Investor

Build a toolkit around Morningstar for valuation and fund research, Seeking Alpha for diverse analytical perspectives, and perhaps Stock Rover if you want to really dig into financial metrics. The free versions of these platforms might be sufficient, though you’ll likely find value in upgrading at least one of them.

Yahoo Finance can serve as your quick-check platform for prices and basic data, while you do your deep research in the other tools. Perhaps check out platforms like AnalyzingMarket com for staying current on broader market trends that might affect your holdings.

If You’re an Active Trader with Significant Capital

At this level, you probably want a comprehensive solution rather than cobbling together free tools. TradingView Premium for charts, Koyfin or Stock Rover Premium for data and screening, plus whatever specialized tools your specific strategy requires.

You might also look at broker-specific platforms—many brokers offer sophisticated tools to active traders that rival standalone platforms. TD Ameritrade’s Thinkorswim and Interactive Brokers’ Trader Workstation are examples of broker platforms that are essentially comprehensive research tools in themselves.

If Budget Is Your Primary Concern

You can absolutely be a successful investor using only free tools. Combine Yahoo Finance for data, Finviz for screening, TradingView free for basic charting, and AnalyzingMarket com for market summaries. Add in the free tiers of Seeking Alpha and Morningstar for research, and you’ve got a surprisingly capable toolkit without spending a dime.

The limitations will be in real-time data (you’ll have delayed quotes), fewer advanced features, and advertisements, but the core functionality for making informed investment decisions is absolutely there.

The Multi-Platform Approach

Here’s something that took me a while to realize: you don’t have to pick just one platform. In fact, most serious investors use multiple tools, each serving a different purpose in their workflow.

A common setup might look like this:

- Primary data platform: Yahoo Finance or Investing.com for checking prices, looking up company data, and portfolio tracking

- Charting platform: TradingView for all technical analysis needs

- News and context: AnalyzingMarket com or Seeking Alpha for understanding what’s driving markets and getting diverse perspectives

- Deep research: Stock Rover or Morningstar when you’re really digging into a potential investment

- Quick scanning: Finviz for efficiently identifying opportunities or seeing market-wide patterns

This might sound like a lot, but each tool serves a specific purpose and you’re not actively using all of them all the time. You develop a routine where you check your primary platform daily, use the charting platform when analyzing potential trades, turn to the research platforms when evaluating new investments, and use the scanning tools when actively looking for opportunities.

The key is not getting overwhelmed by trying to use everything at once. Start with one or two platforms that serve your most immediate needs, get comfortable with them, then gradually expand your toolkit as you identify gaps in your research process.

Common Mistakes to Avoid

Before we wrap up, let’s talk about some pitfalls people often fall into when choosing market analysis tools.

Paying for features you don’t use. This is probably the most common mistake. People sign up for expensive premium tiers because they’re impressed by the feature list, then realize they only use 10% of those features. Be honest about what you’ll actually use before committing to paid subscriptions.

Platform hopping too frequently. It takes time to really learn a platform and develop an efficient workflow with it. If you’re constantly switching to the “next best thing,” you never get past the beginner stage with any single tool. Pick something reasonable and stick with it long enough to truly evaluate whether it meets your needs.

Assuming expensive equals better. The Bloomberg Terminal costs $20,000+ annually, but that doesn’t mean it’ll make you a better investor than using Yahoo Finance. Professional-grade tools are designed for professionals. Unless you have professional-level needs and skills, you’re just wasting money.

Ignoring mobile experience. If you’re someone who checks markets on your phone regularly, make sure the platform you choose actually works well on mobile. Some platforms have excellent desktop experiences but terrible mobile apps, which can be frustrating if that’s how you primarily access them.

Not cross-referencing information. No single platform should be your sole source of truth. Even the most reputable platforms occasionally have errors or biases. Always verify important information across multiple sources before making significant investment decisions.

Forgetting about broker platforms. If you’re already using a broker like TD Ameritrade, Fidelity, or Interactive Brokers, check out what research tools they offer before paying for third-party platforms. Many brokers provide surprisingly robust tools that might eliminate the need for additional subscriptions.

Wrapping It All Up

The right market analysis tool really depends on where you are in your investing journey and what you’re trying to accomplish. There’s no universal winner that beats everything else in every category.

If I had to distill this entire guide down to actionable advice, it would be: start simple, use free tools until you clearly understand what’s missing from your research process, then invest in paid platforms that specifically address those gaps. Don’t try to build the perfect toolkit from day one—let it evolve naturally as your needs become clearer.

For most retail investors, a combination of Yahoo Finance for general data, TradingView for charts, and perhaps one specialized tool based on your investing style will cover 90% of what you need. Whether you add AnalyzingMarket com for simplified market commentary, Morningstar for valuation research, or Seeking Alpha for diverse perspectives comes down to personal preference and what gaps you’re experiencing in your research process.

The tools are just that—tools. They can help you make better decisions, but they can’t make decisions for you. No amount of sophisticated software will turn bad investment logic into good returns. Focus first on developing sound investment principles and strategies, then find the tools that best support those approaches.

And remember, successful investors were making smart decisions long before most of these platforms existed. The tools help with efficiency and access to information, but the thinking part? That’s still on you. If you’re still exploring your options and want to understand specific platforms in more depth, checking out dedicated reviews like our comparison of alternatives can help clarify which direction makes the most sense for your particular situation.

Whatever you choose, make sure it’s something you’ll actually use consistently. The best market analysis tool is the one that fits naturally into your routine and helps you make more informed decisions without creating extra friction in your process. Start there, and adjust as you go.